Spot Contract

Spot Contract :

Fast, Simple, Real-Time FX Transfers

Lock in the live exchange rate and transfer your funds instantly.Fast, Simple, Real-Time FX Transfers

Spot Contracts are the most popular and straightforward way to exchange currency—perfect for both individuals and businesses who need to move money quickly and securely at the current market rate.

At St. George Foreign Exchange, we help clients take advantage of real-time rates to transfer funds across borders with ease—whether you’re:

- Paying overseas suppliers or contractors

- Sending salaries to international employees

- Buying property abroad

- Emigrating or supporting family overseas

Why Use a Spot Contract?

Immediate Fund Transfers

Payments can arrive on the same day—depending on the currency and destination—ensuring fast and efficient delivery.

Real-Time Exchange Rates

Take advantage of current market conditions with no need to wait or target future rates.

No Deposit Required

Unlike other FX products, Spot Contracts typically require no upfront capital, giving you full flexibility.

Expert Support

Speak to one of our dedicated FX specialists by phone or email. We offer tailored solutions and handle everything on your behalf.

When to Use a

Spot Contracts

Spot Contracts are ideal when you need to:

- Make urgent payments

- Pay invoices for goods or services

- Transfer funds for property purchases abroad

- Support family or employees overseas

- Avoid unnecessary delays and complexity

While Spot Contracts offer immediate benefits, they may not be suitable for future-dated payments.

Things to Consider

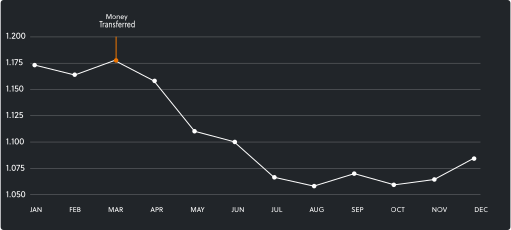

📉 Market Risk: If you need to make a payment weeks or months from now, locking in a rate today may expose you to market fluctuations.

💼 Alternative Solutions: In these cases, consider using a Forward Contract or a Market Order to protect against future exchange rate volatility.

Spot vs. Forward Contracts – What’s the Difference?

Feature | Spot Contract | Forward Contract |

Timing | Immediate transfer | Future-dated transfer (up to 12 months ahead) |

Exchange Rate | Current market rate at time of deal | Locked-in rate from date of agreement |

Best For | Urgent payments | Future budget planning or fixed-rate needs |

How Book a Spot Contract

Once your account is set up, notify us of your recipient’s details and currency requirements. Get a live quote via phone or our online platform.

Agree to the rate, then send funds to our secure client holding account.

We convert the funds and transfer them to your beneficiary. Many payments arrive same-day, depending on the currency and destination.

Is a Spot Contract Right for You?

Our experienced team is here to help. Get in touch to explore your options, understand the market, and discover the best FX strategy for your needs.

- Call us at +441273 661747

- Email us at info@sgfx.uk